Investors & Private Equity

We understand investors’ expectations for objectivity, data, and speed in decision-making. At Summit, we closely partner with investors and their management teams at all stages of the investment cycle, from pre-close management due diligence, post-close organization assessment, working with management on scaling the company, and supporting successful exit strategies.

Management Due Diligence

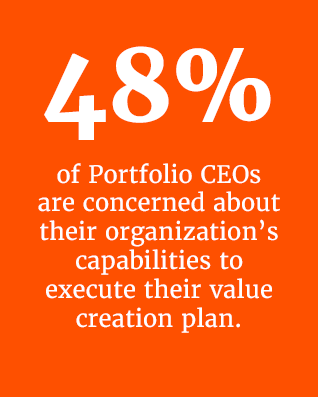

We know from experience that the most critical nonfinancial factor considered when valuing a target investment or acquisition is the quality and health of the management team. Investors have a lot to assess pre-close and usually in a very narrow window of time. We have a proven, quick-turn process to evaluate key management team members’ ability to scale, level of cohesion, and readiness for the next stage. Our insights and recommendations are always grounded in our client’s investment thesis.

Organization Review (Post-Close)

The first 120 days following an acquisition or significant investment are the most critical to understanding and addressing the strategic talent and organization strengths and risks across the company. Our proprietary VCP Accelerator© is a rapid, management-friendly assessment process that drives focus and alignment around the most critical human capital factors to achieve the Value Creation Plan – this includes areas such as management team capabilities, key roles, organization health, talent gaps, and near-term recommendations and actions.

Executive Assessment

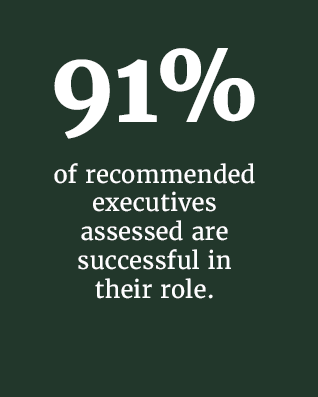

One of the most important decisions a Board or company makes is selecting and preparing the right person for the CXO positions in the company. Failed senior executives result in lost revenue potential, decreased customer or investor confidence, diminished employee engagement, and ultimately a drop in shareholder value. We assess talent using our proprietary methodology to provide our expert recommendations and transition considerations.

Our proven assessments include:

– Placement and Hiring

– Development and Succession Readiness

– 360 Feedback

Team Acceleration

Summit Leadership Partners leverages its proprietary SCALE Leadership Team Assessment© framework to evaluate an executive leadership team’s performance baseline and develop a custom team performance acceleration plan. We work closely with the CEO and their team to align around team purpose, priorities, operating principles, and high performing team behavior skill-building. Our team coaching pushes leaders out of their comfort zones to optimize their collective impact.

Executive Coaching & Development

Our consulting team is comprised of trained coaches who serve as trusted partners, leadership advisors, and catalysts of change for CEOs and their teams. Our coaching is results-driven, designed to address issues in real-time, and focused on improving executive impact and performance with boards, direct reports, and other key stakeholders.

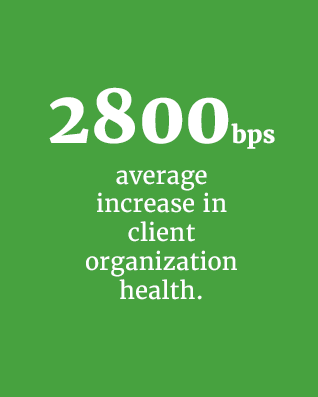

Organization Health Assessment

Most executives know the significant impact culture can have on business performance and investor returns. All companies have their own unique cultures, with the high performers being very intentional about the culture in which they drive strategy and engage their people. In partnership with Entromy, we assess company culture using expert AI and NPL technology to understand and develop an accelerated improvement with management teams.

CEO Succession

A failed CEO succession can disrupt operations, lead to the loss of key talent, damage your company’s reputation, and diminish the organization’s value. Seamless leadership transitions are essential to preserving momentum, building confidence, and driving long-term success. A carefully planned and executed succession strategy aligns your organization’s vision with its strategic goals, ensures stability during periods of change, and strengthens your ability to overcome challenges. Done right, CEO succession is a powerful catalyst for growth, resilience, and creating lasting enterprise value.

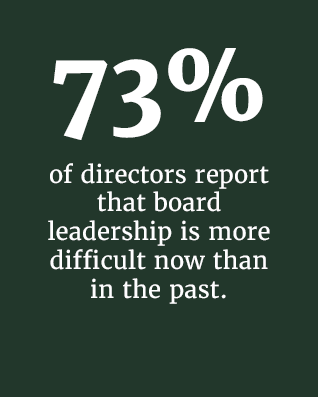

Board Assessment

When delivering on expected investor returns, accountability starts with the Board’s effectiveness. It is critical to establish expertise, clarity, and alignment to create a productive culture and partnership with the CEO. As trained and certified Board experts, we evaluate the Board’s overall impact, identify recommended improvements, and help facilitate change.

Summit is driven by data, investing early in robust data collection to better support our clients with objective data and insights that inform everything we do. We are proud to offer proven client benchmarking, dashboards and predictive insights, allowing investors and business leaders to make more informed decisions that impact talent and organization performance. This includes insights including but not limited to:

– Benchmarks and trends for CEOs, management teams and culture health

– Trends and insights across PE portfolio companies for comparison

– Key insights on the most critical value drivers for business performance

– Improve learnings from hiring trends and patterns