Unlocking Success: Enhancing CEO Selection and Support in Private Equity

For any organization, the CEO role is critical in driving growth, navigating challenges, making the right strategic decisions and delivering on value creation hypotheses. Finding the right CEO fit can be a significant challenge — which is why a strong CEO is worth (much more than) their weight in gold.

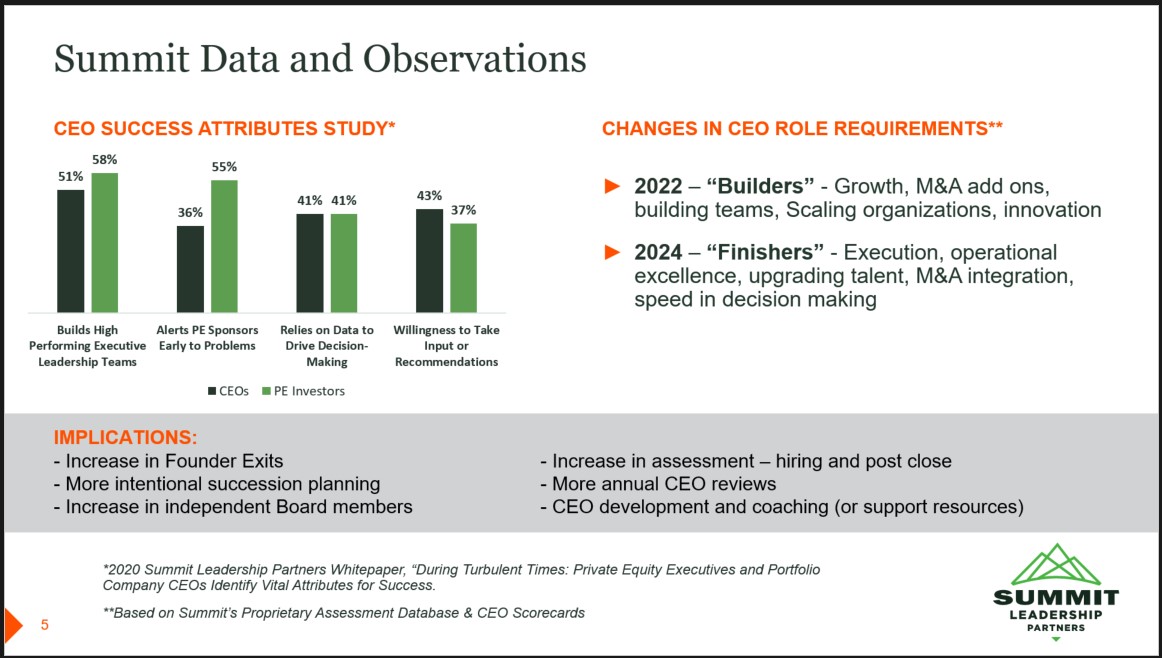

This challenge is magnified in private equity (PE) portfolio companies (portcos), where the pressure to execute a stringent value creation plan is of the utmost importance. During a recent panel I moderated at the Private Equity International Operating Partners Forum in New York, I talked to a few experts on how PE firms can improve their assessment processes, the best onboarding practices, and how PE firms can support the portco CEO to get the best return on their value creation plan. From our proprietary data, we found the CEO role requirements have changed from “Builders” to “Finishers,” echoing the discussion around founder CEOs versus career CEOs.

*slide from panel discussion

Assessing the CEO Beyond the Numbers

Despite investors claims to back and bet on CEOs in an investment thesis, experience indicates that more than 50% of PE portco CEOs are replaced within two years of an investment. Although multiple factors contribute to this statistic, it underscores the importance of thorough assessments in understanding a CEO’s strengths and weaknesses.

When PE firms evaluate potential acquisition targets, there’s a candid question that they must confront: Is the current CEO the right fit for the job as it evolves post-close?

CEO assessments should not solely rely on past performances; a well-rounded picture of the CEO requires examining additional factors that predict how they will perform in the future.

While focusing on financial results provides an immediate gauge of a CEO’s performance, their interpersonal skills are just as important in determining a true fit. The assessment should include conversations with those who work with the CEO to understand how they work with others and the culture they create in the workplace. Our PortCo CEO survey found the biggest challenge for CEOs is the inability to build relationships with the board of directors or leadership team. How collaborative the CEO is has increasingly become a major component of their success.

Additionally, market conditions and external factors should be taken into account when assessing the CEO. If a CEO has faced serious market headwinds or conflicts that are out of their control, but reacted to everything the right way and taken the necessary steps to make improvements when possible, that should be viewed positively.

A CEO success profile will also change depending on where the company is in their lifecycle. For instance, a company in aggressive growth mode requires a CEO with experience driving rapid growth, whereas a company focused on maintaining stability may need a leader skilled in navigating market downturns.

During a deal, the pressure to complete negotiations can cause the deal team to overlook or deprioritize the CEO assessment. This is a mistake and can create problems further into the investment. A CEO can present well during the deal process, understanding the need to be in “sell mode,” but once the deal is finalized the cracks can start to show. Evaluating the CEO before the deal closes gives the deal team a better understanding of the risks and opportunities within their investment’s senior management team.

Efficient Onboarding Strategy

Once you have the right CEO in place — whether they are the existing CEO, or a new leader is brought in — the early onboarding period is critical for setting them up for success. One panelist likened this phase to pre-conflict couples counseling — both sides need to have a clear understanding of what the other is looking for.

The deal team, board members, and other management leaders should align on the expectations for the CEO role within the business. Each stakeholder may have a different opinion on what the ideal CEO will look like, so finding common ground is key to finding a successful pick. Similar to counseling, everyone should be equipped with the vocabulary to talk about issues that arise.

Depending on the CEO’s background, they might also need to be onboarded on how to work within a PE-backed environment. In a PE-backed environment, CEOs operate under intense pressure to deliver rapid results aligned with the firm’s investment horizon, often requiring fast operational changes and cost-cutting measures to meet growth targets.

Ensuring that both sides — the CEO and the PE sponsor — understand and are aligned on expectations in everything from working style to KPIs to hit each month, is vital for a successful ongoing relationship.

Setting the CEO Up for Success Long Term

The goals for each CEO will vary depending on the value creation plan, but several key strategies can help PE firms set their CEOs up for long-term success:

- Set Clear Expectations: At the start of the relationship, both sides need to layout the expectations they have of each other, ranging from specific goals and deadlines to how often communication between teams must happen.

- Create a Strong Partnership: A CEO who has a strong support system is more likely to be open and honest about the company’s status and any challenges they face.

- Make the Board a Resource: The board chair should be a reliable advisor for the CEO, offering guidance as they transition into the role of a PE-backed CEO, and throughout their tenure. Rather than feeling the need to constantly “sell” themselves to the board, the CEO should feel like the board is a valuable resource they can lean on and tap into.

This onboarding process also presents an opportunity for the CEO to meet other CEOs within the PE firm’s portfolio, enabling them to build a supportive network. They can tap into the experiences of others in similar positions, gaining insights and advice that can prove invaluable.

CEOs face a demanding and often isolating role. They typically lack peers within their organization, making it crucial for them to have a solid support system. While at the end of the day, the CEO has a job to do, PE firms can help limit turnover in their management teams. Assessing and finding the right CEO for the right job is the first step; actively supporting the CEO throughout their tenure is what will catapult a CEO to success.

*Based on a panel convened on October 22, at the PEI Operating Partners Forum in New York City.